Getting The Best Investment Books To Work

Wiki Article

The Best Financial commitment Books

Enthusiastic about turning out to be a better investor? There are lots of guides which will help. Effective investors examine thoroughly to produce their skills and remain abreast of emerging procedures for financial commitment.

The 10-Minute Rule for Best Investment Books

Benjamin Graham's The Clever Investor is surely an indispensable manual for virtually any investor. It handles everything from fundamental investing procedures and danger mitigation tactics, to price investing procedures and strategies.

Benjamin Graham's The Clever Investor is surely an indispensable manual for virtually any investor. It handles everything from fundamental investing procedures and danger mitigation tactics, to price investing procedures and strategies.1. The Minor Reserve of Widespread Sense Investing by Peter Lynch

Published in 1949, this common work advocates the value of investing using a margin of security and preferring undervalued stocks. Essential-go through for anyone serious about investing, especially These searching outside of index cash to determine distinct higher-worth long-expression investments. On top of that, it handles diversification concepts along with how to stay away from staying mislead by marketplace fluctuations or other Trader traps.

This reserve provides an in-depth guideline on how to become An effective trader, outlining many of the concepts each and every trader really should know. Subject areas reviewed from the e-book range between sector psychology and paper investing practices, steering clear of prevalent pitfalls such as overtrading or speculation plus more - building this ebook important reading through for major investors who want to be certain they possess an in-depth knowledge of fundamental buying and selling ideas.

Bogle wrote this extensive e-book in 1999 to lose light-weight within the hidden charges that exist in just mutual funds and why most investors would benefit additional from purchasing very low-price index resources. His information of conserving for rainy day cash when not placing all your eggs into 1 basket and also investing in inexpensive index resources remains valid currently as it had been back then.

Robert Kiyosaki has long championed the necessity of diversifying income streams by means of real estate property and dividend investments, notably real estate property and dividends. While Abundant Father Bad Father may perhaps drop far more into own finance than personal progress, Rich Dad Weak Dad continues to be an enlightening read for any person wishing to raised fully grasp compound interest and the way to make their dollars get the job done for them as an alternative to towards them.

For a little something more modern day, JL Collins' 2019 guide can offer some A lot-wanted standpoint. Intended to tackle the needs of financial independence/retire early communities (Hearth), it concentrates on achieving monetary independence as a result of frugal living, cheap index investing as well as the 4% rule - and means to scale back university student financial loans, invest in ESG property and reap the benefits of on the net financial investment resources.

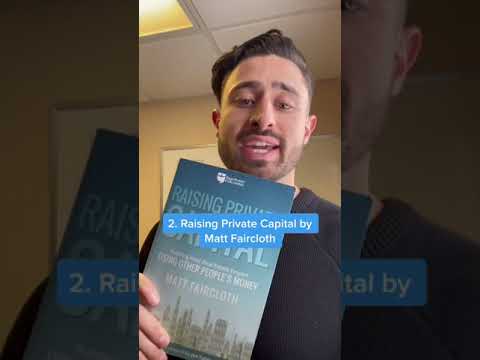

two. The Little Book of Stock Current market Investing by Benjamin Graham

Keen on investing but unsure ways to commence? This reserve provides useful steering created precisely with young traders in your mind, from sizeable scholar personal loan personal debt and aligning investments with particular values, to ESG investing and online fiscal methods.

This greatest expenditure reserve displays you how to discover undervalued shares and produce a portfolio that can give a constant source of earnings. Employing an analogy from grocery browsing, this very best ebook discusses why it is much more prudent to not center on costly, effectively-marketed items but as a substitute think about very low-priced, neglected ones at profits costs. Moreover, diversification, margin of security, and prioritizing value over advancement are all talked about thoroughly during.

A vintage in its discipline, this book explores the fundamentals of price investing and how to recognize possibilities. Drawing upon his expense business Gotham Money which averaged an yearly return of forty % through twenty years. He emphasizes preventing fads even though obtaining undervalued companies with solid earnings potential customers and disregarding quick-phrase marketplace fluctuations as essential principles of successful investing.

This most effective investment reserve's writer presents assistance for new investors to stay away from the problems most novices make and maximize the return on their revenue. With step-by-step Guidelines on making a portfolio created to steadily mature as time passes along with the writer highlighting why index money present by far the most economical suggests of financial commitment, it teaches viewers how to take care of their approach in spite of industry fluctuations.

Best Investment Books - Truths

While initially published in 1923, this book continues to be an a must have tutorial for any person interested in managing their funds and investing sensibly. It chronicles Jesse Livermore's experiences - who acquired and shed tens of millions in excess of his life span - when highlighting the importance of probability theory as part of choice-generating processes.

While initially published in 1923, this book continues to be an a must have tutorial for any person interested in managing their funds and investing sensibly. It chronicles Jesse Livermore's experiences - who acquired and shed tens of millions in excess of his life span - when highlighting the importance of probability theory as part of choice-generating processes.For anyone who is in search of to improve your investing skills, there are quite a few excellent textbooks to choose from for you to select. But with minimal hours in daily and restricted out there looking at substance, prioritizing only All those insights which supply essentially the most value is often difficult - which is why the Blinkist application gives this sort of easy accessibility. By amassing crucial insights from nonfiction guides into bite-sized explainers.

three. The Little Ebook of Price Investing by Robert Kiyosaki

Best Investment Books Can Be Fun For Everyone

This reserve addresses buying businesses with the financial moat - or aggressive edge - for example an economic moat. The creator describes what an economic moat is and gives examples of many of the most renowned companies with a person. Also, this book details how to find out an organization's benefit and purchase shares In keeping with selling price-earnings ratio - ideal for starter traders or any one attempting to find out the fundamentals of investing.

This reserve addresses buying businesses with the financial moat - or aggressive edge - for example an economic moat. The creator describes what an economic moat is and gives examples of many of the most renowned companies with a person. Also, this book details how to find out an organization's benefit and purchase shares In keeping with selling price-earnings ratio - ideal for starter traders or any one attempting to find out the fundamentals of investing.This doorstop investment ebook is both of those well-known and in depth. It handles many of the greatest techniques of investing, which include commencing young, diversifying widely and never paying out large broker fees. Penned in an attractive "kick up your butt" design which can either endear it to visitors or transform you off completely; whilst covering lots of common pieces of recommendation (spend early when Many others are greedy; be cautious when Many others grow to be overexuberant), this textual content also suggests an indexing technique which seriously emphasizes bonds as compared to several comparable methods.

This e book provides an insightful tactic for stock buying. The creator describes how to pick out successful shares by classifying them into 6 unique groups - sluggish growers, stalwarts, quickly growers, cyclical shares, turnarounds and asset plays. By subsequent this uncomplicated process you increase your odds of beating the market.

Peter Lynch is among the world's premier fund managers, owning run Fidelity's Magellan Fund for thirteen several years with an average return that defeat the S&P Index annually. Released in 2000, his reserve highlights Lynch's philosophy for choosing stocks for personal more info traders in an obtainable method that stands in stark contrast to Wall Road's arrogant and extremely complex strategy.